cares act stimulus check tax refund

For federal tax purposes a forgiven PPP loan is not taxable. This is a deferral not forgiveness so those amounts will eventually have to be repaid.

Faqs On Tax Returns And The Coronavirus

College students who are claimed as dependents on their parents tax return will.

. Those who make. Here are four things to know about the CARES Act. Rather than filing an amended 2018 return to claim the credits the CARES Act allows the taxpayer to file an application for a tentative refund quickie refund by December 31 2020 to claim its remaining MTCs for its 2018 tax year.

The District of Columbia and US. The first round of stimulus checks mandated by the Coronavirus Aid Relief and Economic Security CARES Act was signed into law in March 2020. In the event your PPP loan is not forgiven its treated like a normal loan and its not considered taxable.

COVID-19 Stimulus Checks for Individuals The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible. You may soon receive a 1200 or 2400 stimulus check from the government if you set up your tax refund with direct deposit though it will be a longer wait if you need a paper check. Territories consisting of the.

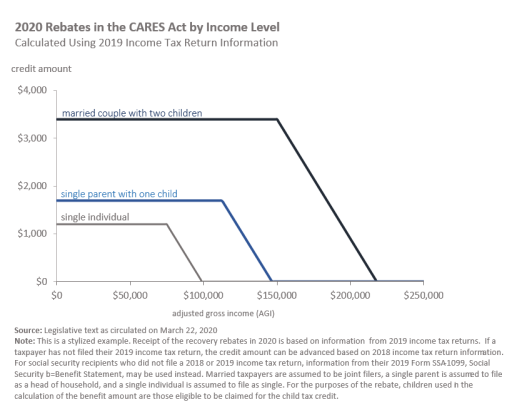

Parents also receive 500 for each qualifying child child must qualify for Child Tax Credit. As Coronavirus COVID-19 continues to disrupt the US. Single filers who earn between 75000 99000 will get a reduced amount.

Here are the numbers. To find the amounts of your Economic Impact Payments check. To help provide relief in these unprecedented times the Coronavirus Aid Relief and Economic Security Act CARES a 2 trillion stimulus package to help individuals families and businesses was signed into law.

For every 100 earned over 75000 their check will be reduced by 5. The plain and simple answer to that question is that stimulus payments are tax-free. As a result of the CARES Act which became law on March 27 2020 most Americans will receive stimulus checks.

Up to 75000 if single or you filed taxes married filing separately. The CARES Act gave a maximum 1200 per person and 500 per eligible dependent child under 17. And for each child under the age of 17 parents will get 500.

Because youre getting what amounts to a refundable tax credit now in the form of a third stimulus payment rather than waiting to get the money from the credit in 2022 when you actually file your 2021 tax return youre in effect. Economy many have turned to the federal government for hope. If you received any stimulus check or got a direct deposit of economic impact payments EIP or through a stimulus EIP Debit card a question may hover if the payment will actually increase your tax or reduce your expected tax refunds during the year 2021.

The CARES Act also allows self-employed taxpayers to defer 50 of the Social Security portion of self-employment tax for March 27 through December 31 2020. Congress and signed into law by President Donald Trump on March 27 2020 in response to the economic fallout of the COVID disease. 1200 in April 2020 600 in December 2020January 2021 1400 in March 2021 These payments were sent by direct deposit to a bank account or by mail as a paper check or a debit card.

For every 100 earned over 150000 their check will be reduced by 5. Under the law the Fund is to be used to make payments for specified uses to States and certain local governments. Eligible taxpayers who filed tax returns for either 2019 or 2018 will automatically receive an economic impact payment of up to 1200 for individuals or 2400 for married couples.

However based on the CARES Act rules that wont apply to forgiven PPP loans. Households will receive an additional 1400 for each dependent claimed on their most recent tax return but only if the. Three ways your eligibility may change for the 1400 stimulus checks Under the terms individuals could receive up to 1400 through the third stimulus checks.

You are eligible to get a stimulus check and will receive the FULL amount if you filed taxes and have an adjusted gross income of. Up to 112500 if you filed as head of household. Securely access your individual IRS account online to view the total of your first second and third Economic Impact Payment amounts under the Economic Impact Payment Information section on the Tax Records page.

Half of the deferred amount is due on December 31 2021 and the other half is due December 31 2022. Married filers who earn between 150000 198000 will get a reduced amount. The Coronavirus Aid Relief and Economic Security Act also known as the CARES Act is a 22 trillion economic stimulus bill passed by the 116th US.

Of course there are some stipulations. Who would qualify. Payments were limited by 2019 or 2018 income as reported on federal income tax forms.

We mailed these notices to. Check out our Stimulus Check Calculator. The federal coronavirus aid relief and economic security act cares act consolidated appropriations act 2021 and american rescue plan act of 2021 contained a number of tax provisions that impact the computation of taxable income for individuals and businesses modify eligibility for certain tax credits and provide assistance to taxpayers.

The Coronavirus Aid Relief and Economic Security Act CARES Act established the Coronavirus Relief Fund Fund and appropriated 150 billion to the Fund. For example if you owed 1000 in taxes but had a refundable tax credit of 1200 youd get a 200 tax refund check from Uncle Sam. This form can be filed immediately to accelerate to refund.

The spending primarily includes 300 billion in one-time cash payments to individual people who. Married taxpayers will get 2400. Aside from the price requirement single tax filers must make under 75000 a year and those who are married must make under 150000 to receive the full benefit.

Taxpayers who file head of household with an AGI under 112500 will receive a 1400 stimulus payment. Single taxpayers will get 1200. Up to 150000 if married and you filed a joint tax return.

The CARES Act was signed into law on March 27 2020 and the first stimulus check which maxed out at 1200 per person with an extra 500 per dependent would have arrived as early as mid-April. Couples who file jointly could get. Normally a forgiven loan will be counted as cancelled debt which is considered taxable income.

Third Stimulus Check Update How To Track 1 400 Payment Status Abc10 Com

Trump Signs Covid Relief Bill 600 Stimulus Checks Go Out This Week

All You Wanted To Know About Those Tax Stimulus Checks But Were Afraid To Ask

Covid 19 And Direct Payments To Individuals Summary Of The 2020 Recovery Rebates In The Cares Act As Circulated March 22 Everycrsreport Com

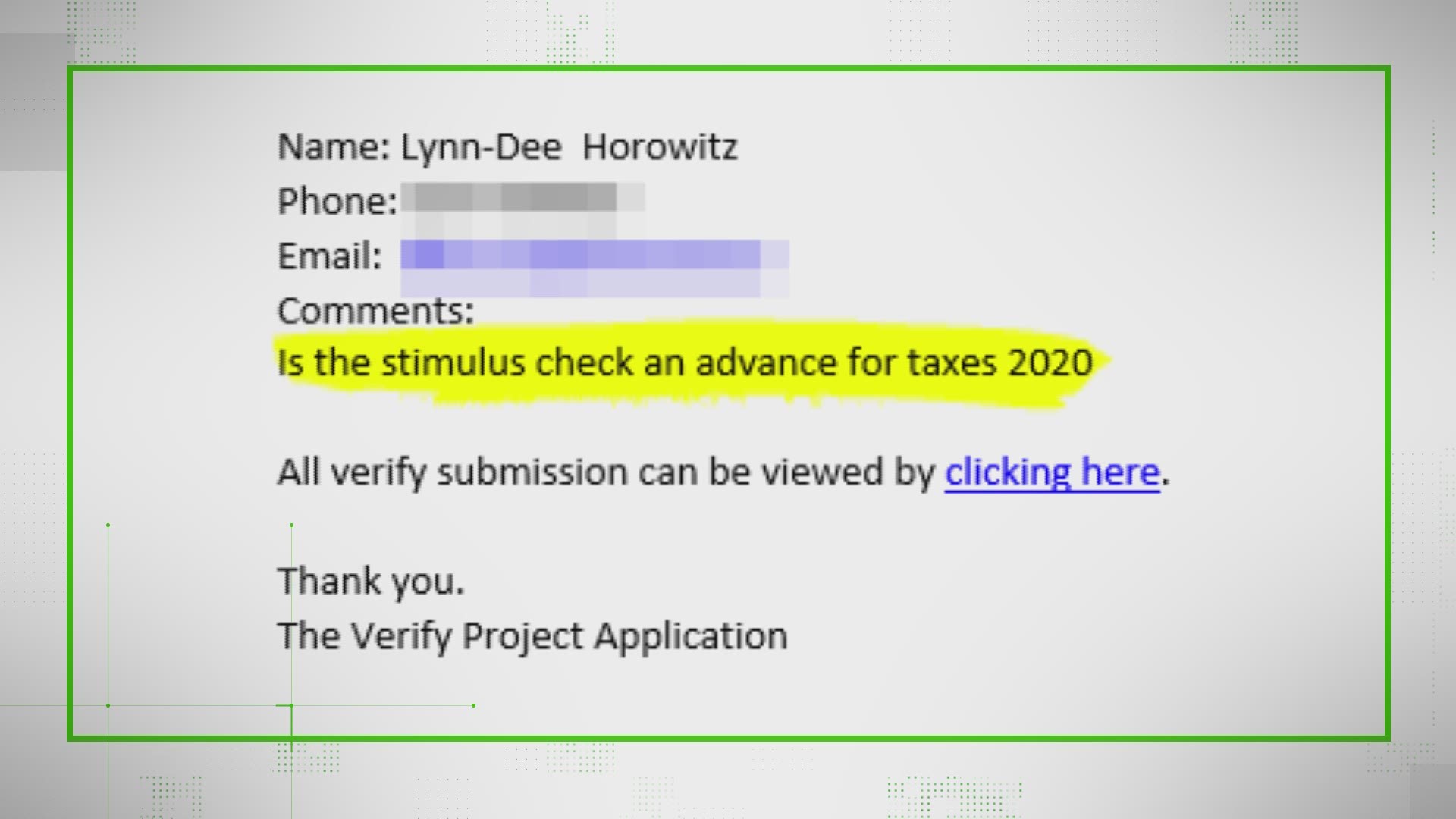

Will The Stimulus Money Be Deducted From Your Refund Next Year 11alive Com

Stimulus Payments May Be Offset By Tax Debt The Washington Post

Did Cares Act Benefits Reach Vulnerable Americans Evidence From A National Survey

Stimulus Checks And Child Support King Law

How To Claim A Missing Stimulus Check

Nonresident Guide To Cares Act Stimulus Checks

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

How To Claim Missing Stimulus Payments On Your 2020 Tax Return

Key Dates For The Next Set Of Stimulus Payments The Washington Post

Look For Line 30 On Your 1040 To Claim Your Stimulus Payment The Washington Post

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

All You Need To Know About Round Two Of Covid Related Stimulus Checks

Federal Aid In 2022 No More Stimulus Checks In Sight Child Tax Credit Payments Expired Abc7 Chicago

Federal Aid In 2022 No More Stimulus Checks In Sight Child Tax Credit Payments Expired Abc7 Chicago