travel nurse taxes allnurses

Allnurses is a Nursing Career Support site. Our members represent more than 60 professional nursing specialties.

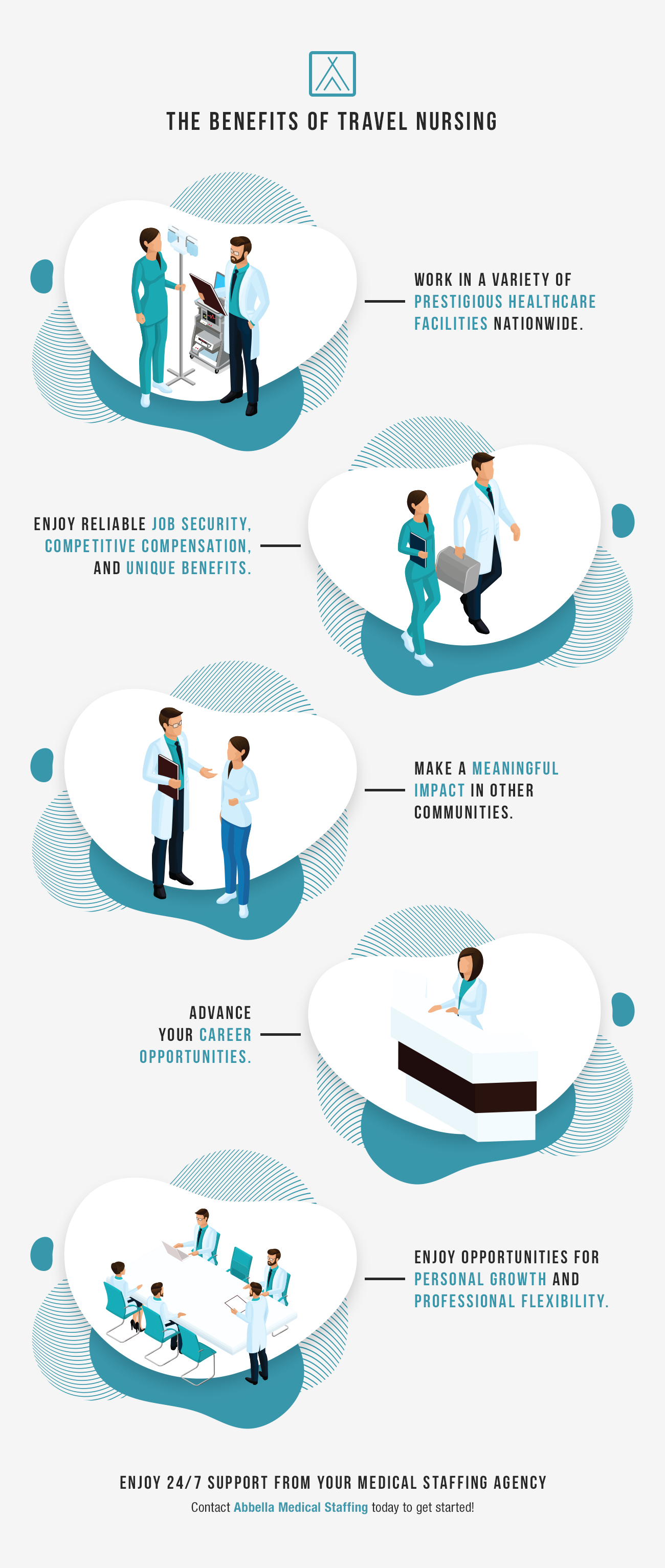

The Benefits Of Travel Nursing Learn More And Apply Abbella Medical Staffing

Nursing explains that every state has different laws for filing taxes but travel nurses must file a non-resident tax return in every state they have worked in as well as the state thats your permanent tax home.

. Our mission is to Empower Unite and Advance every nurse student and educator. As of April 2 34 states Washington DC and Puerto Rico are following the federal government and have extended the filing date to July 15 2020. Allnurses is a Nursing Career Support site.

To your healthcare colleagues you are paid. This means travel nurses can no longer deduct travel-related expenses such as food mileage gas and license fees and the only way to recuperate this money is either through a stipend from your travel agency or in the form of reimbursements for expenses you actually. You yourself know you are doing awesome or at least better financially.

20 per hour taxable base rate that is reported to the IRS. This is the most common Tax Questions of Travel Nurses we receive all year. Our mission is to Empower Unite and Advance every nurse student and educator.

Since 1997 allnurses is trusted by nurses around the globe. FREE REVIEW OF PREVIOUSLY FILED TAX RETURNS. The site offers short and long-term home apartment or condo options.

What are Non-Taxed Stipends for Travel Nurses. Smith advises travel nurses keep a receipt book to help them make tax preparation a little easier by having all of their paperwork in one. Its important to note wages can increase between travel nurse companies and will also vary depending on certifications and unit placement.

Since 1997 allnurses is trusted by nurses around the globe. Since 1997 allnurses is trusted by nurses around the globe. Our members represent more than 60 professional nursing specialties.

If you are traveling away from home on business which is what most travel nurses do the IRS allows you to deduct expenses on your tax return. Travel nurses receive both taxable hourly rates and non-taxed stipends. Our mission is to Empower Unite and Advance every nurse student and educator.

They protect your payment against fraud and a dedicated care. Allnurses is a Nursing Career Support site. Travel nurse tax tips.

Our mission is to Empower Unite and Advance every nurse student and educator. Go to our Traveler page for Workbooks FAQs and helpful links. He can deduct travel costs meals at 50 and lodging.

You can review this four part series 1 2 3 4 for detailed information on how to accomplish this. Filing taxes for travel nurses are subject to different due dates. Allnurses is a Nursing Career Support site.

The most prominent Travel Nurse Tax Deductions are Tax-Free Stipends for Housing Meals Incidentals Travel Reimbursements and Professional Development Costs. A blended rate combines an hourly taxable wage such as 20 an hour with your non-taxable reimbursements and stipends to give you a higher hourly rate. First travel nurses should consider the possibility of establishing and maintaining a tax-home so that they can qualify to receive the tax-free stipends.

Consider using a tax advisor. A tax advisor can be helpful in filing travel nurse taxes with everything from understanding the original contract to calling payroll offices and agencies. Our members represent more than 60 professional nursing specialties.

Your friends and family know you started this journey with the intention of making more than you did as staff. Tax Preparation for Travelers Travel Nurses Allied Health Locums Engineers and other traveling professionals have unique situations. In addition to non-taxed stipends travel nurses also receive hourly pay.

Allnurses is a Nursing Career Support site. Think salesman flying into some city for a couple of days. Since 1997 allnurses is trusted by nurses around the globe.

Establishing a Tax Home. Non-taxed stipends are used for expenses such as housing meals and other incidentals. Not just at tax time.

What Factors Impact Your Pay as a Travel Nurse. Allnurses is a Nursing Career Support site. Tax-Free Stipends for Housing Meals Incidentals.

Our members represent more than 60 professional nursing specialties. At Travel Nurse Tax we are an independent tax preparation firm and our focus is on the tax needs of travelers and non-travelers alike. 1 A tax home is your main area not state of work.

Our members represent more than 60 professional nursing specialties. FEDERAL AND STATE TAX. Since 1997 allnurses is trusted by nurses around the globe.

Under the new 2018 tax laws deductions or write-offs are no longer an option for travel nurses. Since 1997 allnurses is trusted by nurses around the globe. For example scrubs lab coats or medical shoes are items you can write off when doing your taxes.

The only condition to qualify for Tax-Free income is that the traveler must be working in a state that is not their tax home. Since 1997 allnurses is trusted by nurses around the globe. Allnurses is a Nursing Career Support site.

VBRO is a very trusted housing site for travel nurses. Our mission is to Empower Unite and Advance every nurse student and educator. So lets take a look at a few tax tips for nurses and the most common things you can deduct.

Our members represent more than 60 professional nursing specialties. Smith says If theres a problem I get results whereas if people try to call themselves they wont get results. Our members represent more than 60 professional nursing specialties.

Our mission is to Empower Unite and Advance every nurse student and educator. I assume that those who believe they dont have a tax-home are harboring this belief because. They are ready for you to foot the bill at lunch.

Your work outfit has to be specific to the work you do as a Healthcare Professional Pharmacist or Nurse. 4 Common Tax Deductions for Nurses Mid-wives and other Healthcare Professional. Our mission is to Empower Unite and Advance every nurse student and educator.

Sep 2 2018. Being a traveling nurse comes with many appealing benefits. Travel Nurse Tax Deduction 1.

But travel nursing does come with a few financial pitfalls unless youre smart about handling your tax deductions. FREE YEARLY TAX ORGANIZER WORKSHEET. Tips for the travel nurse buying a house.

Many states are still expecting residents to file by April 15th and still assessing penalties for those who file late. It is also the most important since the determination of whether per diems stipends allowances or subsidies are taxable. 250 per week for meals and incidentals non-taxable.

I could spend a long time on this but here is the 3-sentence definition. We consult and prepare your taxes via phone and internet. Here is an example of a typical pay package.

VBRO is committed to user safety and comfort.

Amazon Com Windham Calling All Nurses Nursing Words

How To Stop Travel Nurse Bullying Travel Nursing Nurse Healthcare Infographics

Are Nurses Guilty Of Price Gouging For Being Paid 10 000 Per Week In Nyc Which Is Significantly Higher Than Normal American Enterprise Institute Aei

Nurse Travel Nursing Nurse Midwife

Report What It S Like To Be A Travel Nurse During A Pandemic

The Traveler S I Ve Seen Add Yours General Nursing Support Stories Allnurses

How Does Travel Nursing Work Trusted Nurse Staffing

5 Factors That Depress Travel Nursing Pay Rates Bluepipes

Travel Rn To New Fnp Is It Worth It Nurse Practitioners Np Allnurses

Ttatn 035 What Is The Annual Salary Of A Travel Nurse Bluepipes Blog

Word Of Warning About Tax Consequences For Travel Nurses Travel Nursing Allnurses

How Much Do You Really Make As A Travel Nurse Travel Nursing Allnurses

Travel Nurses Share Your Stories Travel Nursing Allnurses

Nurse Licensure Compact States Travelnursing Com

Report What It S Like To Be A Travel Nurse During A Pandemic

Is This Covid Era Travel Money For Real Sustainable Travel Nursing Allnurses

Travel Nurses Share Your Stories Travel Nursing Nurse Nurse Humor